Will it be a Solana Summer?

Solana is a blockchain that’s been gaining lots of traction in recent months. In the last 90 days alone, Solana’s market cap has risen from $3.8 billion to $10.7 billion, making it the 13th largest cryptocurrency by market cap.

The Solana ecosystem is young but promising. Like any blockchain, Solana has its trade offs, but there are no shortage of builders flocking over. A master list of projects building on Solana can be found here.

Additionally, a beginners guide to Solana can be found here.

Finally, a partnership between Solana and RenVM was announced today. The RenVM integration will allow for the bridging of assets like Bitcoin and Doge so that they can be used on the Solana blockchain.

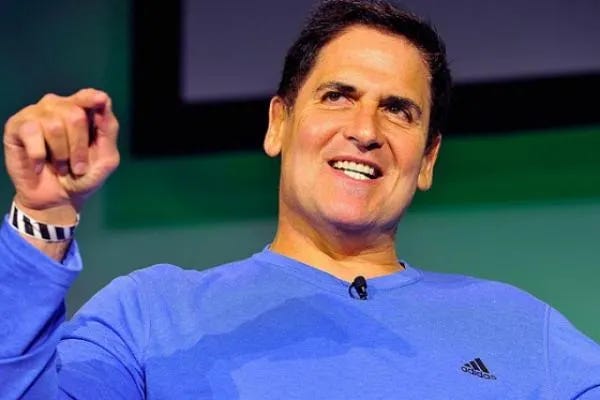

Mark Cuban on why Polygon ($MATIC) is here to stay

The main takeaway from this article is that despite Polygon having a lower market cap than competing Layer-1 blockchains like Cardano, Ripple, and Polkadot, Polygon actually has users and functional applications.

Many blue-chip DeFi protocols from Ethereum have ported over to Polygon and are offering incentives for users to migrate funds over from Ethereum. This is in large part why DeFi dapps (decentralized apps) on Polygon are able to capture anywhere from hundreds of millions to billions of dollars in total value locked.

Adamant Finance, for example, is a yield aggregator that has had $300 million deposited to their platform within the last two weeks.

Aave continues $MATIC liquidity mining incentives on Polygon

As mentioned above, many dapps on Polygon are incentivizing users to move funds to Polygon.

Aave has been running liquidity mining incentives for the last month or two. By offering lenders/borrowers (on Polygon) additional interest in the form of $MATIC, Aave has reached $5 billion locked on Polygon alone (currently $20 billion locked on Ethereum).

Today, Polygon announced that they will keep the momentum going by extending Aave’s liquidity mining program with an additional $85 million worth of $MATIC tokens.

Paraguay plans to legislate Bitcoin

After Paraguayan congressman Carlos Rejala hinted at a partnership between PayPal and El Salvador last week, some more details have come to light.

The largest Metaverse LAND acquisition to date occurred today in Decentraland

The 259-parcel estate was sold to Republic Realm, an IRL and metaverse real estate investment firm, for $913k. Republic owns a significant amount of land in The Sandbox as well.

With this new acquisition in Decentraland, it looks like they’re planning to build out Metajuku - a Harajuku-themed shopping district.

—-

That’s all for today.

Onward,

Josh